Not All Boats Are Sinking With The Market’s Tide – These Outperforming Areas Are Poised For Further Upside

It was a tough week for investors after Fed Chair Powell put a halt to a 2-week rally that had been fueled by sharp gains in companies reporting 3rd quarter results ahead of lowered estimates. Going into this week, the S&P 500 had bullishly broken back above its 50-day moving average in a move that capped an 8% gain for this broad based Index.

Last week’s negative response to Powell’s hawkish comments hit mega-cap tech names the hardest; with Apple, Alphabet and Amazon down double digits for the week. The Technology sector was the worst performing as the proposal of a more prolonged rate hike cycle with a higher peak rate, pushed these growth stocks lower. The declines here and elsewhere, pushed the S&P 500 back below its key 50-day moving average.

Despite the damage to areas most susceptible to a rising interest rate environment, there are several sectors of the market that are not only holding in, they’re exhibiting bullish characteristics and have underlying stocks breaking out of sound bases and to new highs.

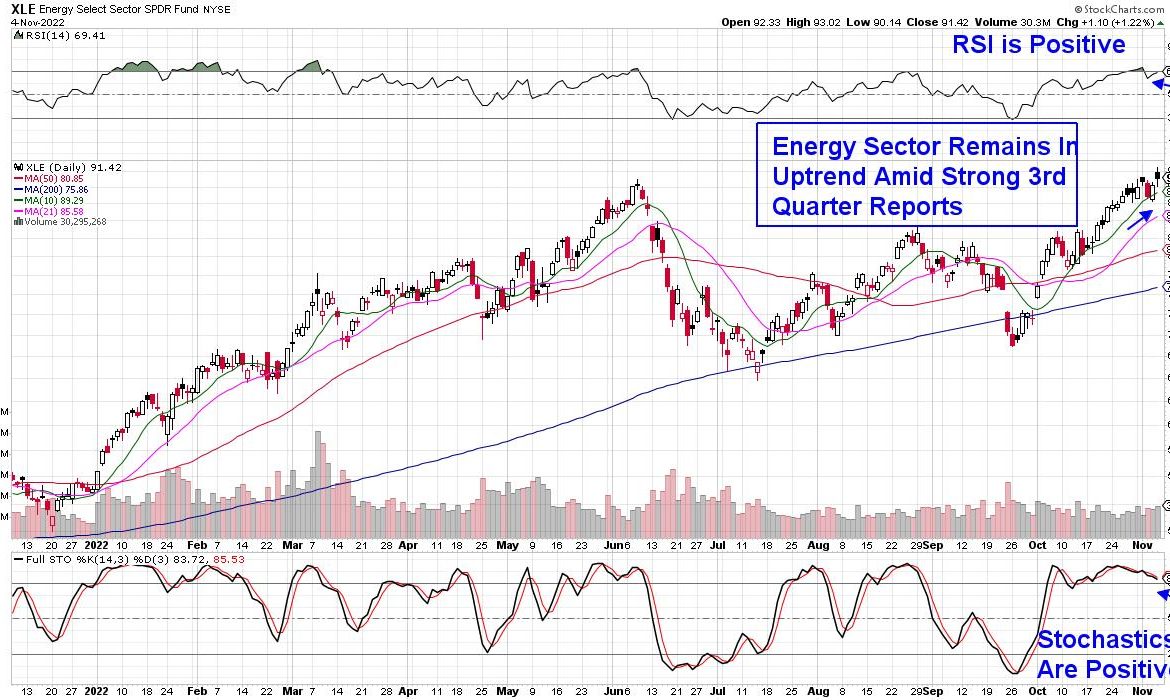

The Energy, Healthcare and Industrial sectors are all trading above key moving averages with healthy looking charts. Energy in particular is the strongest, with many companies reporting robust 3rd quarter results on the heels of elevated oil prices. Healthcare remains uplifted due to new drug approvals and a demand for products that’s resilient to any economic slowdown. Industrials have their own pockets of strength as spending on infrastructure and other projects is boosting shares of companies such as bellwether name Caterpillar (CAT) that’s been rallying on a positive global demand outlook.

As for ways to trade stocks in these relatively strong areas of the market, investors will need to keep a relatively short-term time horizon until the S&P regains its 50-day moving average.

Of the 3 sectors highlighted above, I’m most interested in Energy and Healthcare stocks as these are two areas that can 1) trade higher in a rising rate environment (Energy) and 2) have performed well in recessionary periods such as 2008 (Healthcare). You’ll want to search for stocks that are trading above key moving averages (21, 50 and 200-day simple moving averages), and have already reported earnings.

DAILY CHART OF ENERGY SECTOR (XLE)

Within Energy, Oil & Gas Transport stocks have the most potential as Europe’s Oil embargo against Russia is set to take place beginning in December.

Amid Healthcare, many Biotech stocks are setting up for continued outperformance after several well known companies in this area reported strong 3rd results while guiding growth prospects higher.

For those who would like immediate access to my culled list of select stocks in Healthcare and Energy that are poised to trade higher, use this link here to access a 4-week trial of my twice weekly MEM Edge Report. You’ll also receive insights into support and resistance areas for the markets as well as be alerted to shifts in sentiment.

Next week is setting up to be another volatile period with the elections on Tuesday and Consumer Price Index data due to be released on Friday. In addition, there’ll be over 8 appearances by Federal Reserve officials with their comments being dissected for hints of future rate hike policy.

Be sure and use this link here to trial my twice weekly MEM Edge Report for a nominal fee. Based on historical precedence, we expect strength to continue in the areas highlighted above with newer areas such as select retailers in the beginning stages of turning higher ahead of the release of their earnings later this month.

Warmly,

Mary Ellen McGonagle, MEM Investment Research