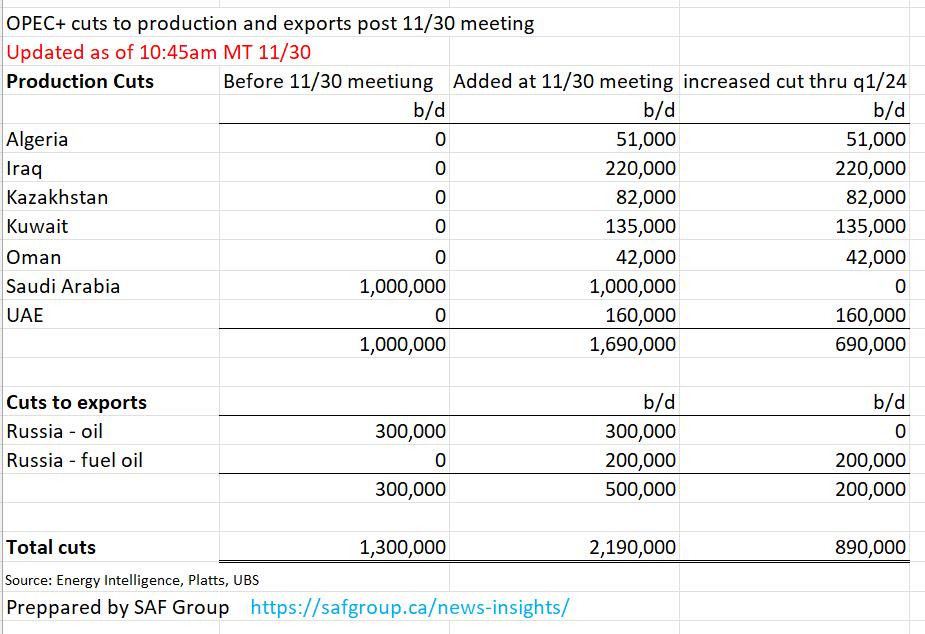

Despite the total cuts by all countries added at the November 30th OPEC+ meeting, oil sold off, testing key support. Countries like Angola have threatened not to stick to the new quota, promising to produce above target. Meanwhile, Brazil confirmed it will join OPEC+. That means that some of the pressure by non-OPEC producing countries offsetting the cuts is now somewhat mitigated.

Nonetheless, the question is, once the dust settles, will these 2.2 million barrels a day cuts hurt supply?

Furthermore, in a story by Consumer Reports, they wrote, “EVs are less reliable than conventional vehicles, having nearly 80% more problems and are generally less reliable than cars propelled by conventional internal combustion engines.” That could certainly help drive demand towards gas-fueled cars, or at least hybrids.

The real question is though, what does price tell us?

Looking at WTI crude oil, $75 is a great line on the sand for support. $80 is the resistance to clear. The best we can say after today’s action is that oil is ranging and trying to figure out its next moves.

The monthly chart, which will change tomorrow (December 1), shows price sitting right on both the 23 and 80-month moving averages. 70.43 in the US Oil Fund ETF USO is a good near-term point to hold to make the case for more upside. We begin December above that level, good. And if USO gets and holds above 73, even better.

With weaker global economic expectations keeping prices under pressure, oil in general seems vulnerable to any wild shift in price and is very much headline dependent.

This is for educational purposes only. Trading comes with risk.

If you find it difficult to execute the MarketGauge strategies or would like to explore how we can do it for you, please email Ben Scheibe at Benny@MGAMLLC.com, our Head of Institutional Sales. Cell: 612-518-2482.

For more detailed trading information about our blended models, tools and trader education courses, contact Rob Quinn, our Chief Strategy Consultant, to learn more.

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealth.

Grow your wealth today and plant your money tree!

“I grew my money tree and so can you!” – Mish Schneider

Follow Mish on Twitter @marketminute for stock picks and more. Follow Mish on Instagram (mishschneider) for daily morning videos. To see updated media clips, click here.

Mish in the Media

Mish makes the case for Vaxcyte (PCVX) and presents the bullish case for gold in this appearance on Business First AM.

Mish talks about money supply, debt, the consumer, inflation and trends that could gain traction in 2024 with Nicole Petallides on Schwab Network.

On the Tuesday, November 28 edition of StockCharts TV’s Your Daily Five, Mish presents 6 stock picks with specific actionable plans.

Mish covers the technical setup for Palo Alto and how MarketGauge’s quant models found this winner on Business First AM.

Mish and Maggie Lake cover inflation, technology, commodities and stock picks in this interview with Real Vision.

Mish talks trading range, fundamentals, and how to think about commodities right now on Yahoo! Finance.

In this appearance on BNN Bloomberg, Mish covers the emotional state of oil and gold, plus talks why small caps are the key right now. She also presents a couple of picks!

Learn how to trade commodities better with Mish in this interview with CNBC Asia!

Mish and Charles Payne discuss why the small caps, now in mid range still have a chance to rally in this appearance on Fox Business’ Making Money with Charles Payne.

Mish talks about Tencent Music Entertainment on Business First AM.

Mish talks bonds with Charles Payne in this clip from October 27, recorded live in-studio at Fox Business.

Coming Up:

December 3-December 13: Money Show Webinar-at-Sea

December 14: The Final Bar with David Keller, StockCharts TV

December 20: Outlook 2024 with StockCharts

December 22: Yahoo! Finance

December 28: Singapore Breakfast Radio

Weekly: Business First AM, CMC Markets

ETF Summary

S&P 500 (SPY): 450 support, 465 resistance.Russell 2000 (IWM): 181 resistance, 177 support.Dow (DIA): 360 resistance, 346 support.Nasdaq (QQQ): 388 now pivotal.Regional Banks (KRE): 45 pivotal.Semiconductors (SMH): 160-161 pivotal support.Transportation (IYT): 235 support, 250 key resistance.Biotechnology (IBB): 120 pivotal.Retail (XRT): 65 resistance.

Mish Schneider

MarketGauge.com

Director of Trading Research and Education