Chevron: Navigating the Intersection of Technical Uncertainty and Fundamental Strength

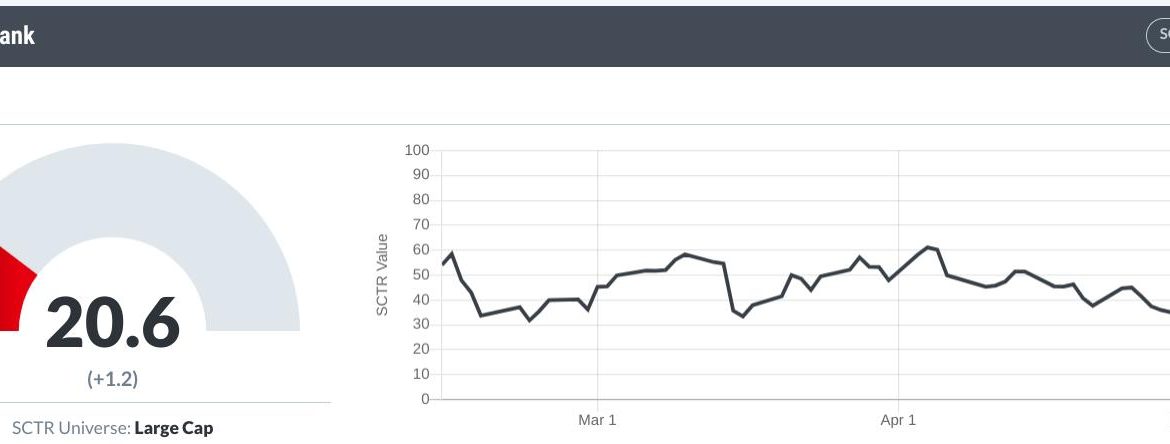

Chevron’s (CVX) technical health could be in better shape according to numerous indicators best summed up by the StockCharts Technical Rank (STCR) score. Talking about underwhelming performance, CVX is clearly in decline.

But a decline from where and to what? (A better question, perhaps). CVX is declining from its all-time high of $186.57, which it hit last November. The stock is sitting between its 52-week high and 52-week low of $129.20. But where’s it going?

Right now, CVX is just a few points above a rising trend line that can be traced as far back as July 2022. On one hand, CVX’s technical outlook seems a little precarious, especially if it breaks below the trend line. Still, we have to ask if there’s any other reason—technically or fundamentally—why CVX might hold.

The Fundamental Picture

Chevron is Berkshire Hathaway’s third-largest holding and among the company’s dividend-yielding stocks. The price of oil is likely to remain at relatively high levels thanks to limited supply, continuous demand, and geopolitical tensions. Chevron is well-positioned to benefit from this.

But CVX doesn’t necessarily rely on high oil prices to profit. The company has both “upstream” and “downstream” operations. This means CVX can profit from downstream operations when crude oil prices are low or static. Plus, the company’s dividend seems reliable, making CVX a solid choice for investing in the energy sector.

Enter CVX in the Symbol Summary tool to check out company dividends.

The Technical Picture

The 50-under-the-200 SA crossing (aka Death Cross) appears to bear down, like a crushing weight, against the promising trend line (green) that’s starting to look a little thin. Another potential challenge for upward momentum is the “local” swing high at $172.88. This price point must be surpassed to overturn the stock’s six-month downward trend. It also aligns with the Volume by Price indicator’s longest bar at the $172 range. These points suggest the likelihood of strong resistance because of its historical selling pressure.

On the upside, CVX seems to be armed with a strong Q1 2023 earnings surprise that bucked declining oil prices, a strong upstream/downstream business model, a rising trendline, a nice bounce from an oversold Stochastic Oscillator reading, and an RSI low.

The upside case may not seem like much. But in this geopolitically-charged space that virtually powers the global economy, strong fundamental prospects, paired with just enough of a technical catalyst, may be sufficient to trigger a contrarian reversal.

Trading CVX

For trade entry ideas, let’s switch to the StockChartsACP platform.

A relatively safe early entry would be upon a breakout of the downsloping trendline (see dashed blue line). Strong volume would be preferable.

There are two places you might want to consider for your stop loss. The first is right below the rising trendline (highest red horizontal line). That’s not a fixed position; it can be a trailing stop for wherever the trend line happens to be at the time of entry. The second stop would be below the local low, at around $150.00.

As far as your profit target is concerned, it depends on whether you’re looking to hold on for the long haul (an investment position) or a swing trade. If you’re swing trading this position, resistance at the $170 and $186 range would make sense.

The Bottom Line

Chevron presents a complex investment landscape that intertwines technical and fundamental realities.

Although the technical outlook is somewhat precarious, there are encouraging signs to counter overly-bearish sentiment. The fundamental case remains promising. CVX is a major holding for Berkshire Hathaway, indicating notable investor confidence, and its diversified business model allows it to profit in varying oil price conditions. Furthermore, the company’s consistent dividend makes it an attractive choice for income-focused investors. Still, a lot can change in a short time. So, if you want to add CVX to your portfolio, keep an eye on both (technical and fundamental) aspects when planning your entry.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.