There’s a simple professional trader’s tactic for anticipating intraday market reversals near the levels that later become the high or the low of the day. This tactic worked perfectly at calling today’s high of the day in SPY (and the QQQ, IWM, and DIA). This simple indicator works even better when the market’s sector rotation leads the move like it did today, so let’s start there.

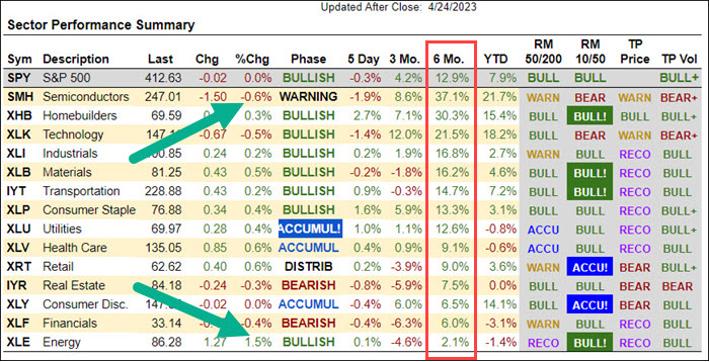

Today’s image is our sector summary table, which you can find for free in the “Big View” section of marketgauge.com. The table is ranked by 6-month change (outlined in red) because we’ve found that timeframe to be significant when gauging the persistence of trends. As you can see, there was an interesting pattern of market rotation today (pointed out by the green arrows).

The pattern is simply that the leading sector (over the last 6 months), SMH, was today’s biggest loser on a percentage basis, while in contrast, the weakest sector, XLE, was today’s biggest winner. In an otherwise quiet, choppy day, this sector rotation bookended the mood of traders who were focused on bespoke stock stories like earnings that didn’t translate into a general market trend.

If you read yesterday’s edition of this article, “SMH Bulls Are Skating On Thin Ice,” weakness in this leading sector shouldn’t come as a surprise. If you’re also aware of our simple tactics for anticipating intraday market reversals and trend days, then the trend days in both SMH and XLE should not come as a surprise, even though they were bucking their longer-term trends.

The simple tactic I’m referring to that enables you to anticipate daily highs and lows and trend days is the proper use of the Opening Range indicator.

The two-sentence tutorial for understanding the Opening Range is as follows…

The low and high of the first 30 minutes of the day will be significant support and resistance, and you should look for reversal patterns at these levels. If the market exhibits a confirmed breakout beyond the O.R. high or low, it is often a trend day.

With that in mind, look at the intra-day charts of SMH and XLE. Notice in the SMH chart that, when the price broke the OR low, it trended lower. In the XLE chart, when the price broke the OR high it rallied, retraced to the OR high area, then resumed its trend higher.

Now let’s look at the reversal at the high of the day in the SPY chart below.

Notice I’m showing you the QQQ chart too. The simple advanced Opening Range tactic for anticipating a market reversal is to look for divergences in the indexes at the Opening Range levels. The red circles show an example of the SPY attempting to break over the OR high, while the QQQ demonstrates a significant negative divergence. When you see a divergence like this, expect the SPY to reverse.

If you consider the two sets of charts together, you can see how the SHM started the day on a positive note, but never made an attempt to move over its OR high like the SPY, indicating that the market’s leader was not bullish today. This contributed to the weakness in the QQQ.

Intraday trading patterns aren’t just for day traders. Today’s SMH chart is a good example of using the Opening Range to avoid buying into a weak day in the leading sector, but…

Of course, if you’re reading this article daily, you know it’s not a good time to be buying SMH for other reasons.

For more detailed trading information about our blended models, tools and trader education courses, contact Rob Quinn, our Chief Strategy Consultant, to learn more.

IT’S NOT TOO LATE! Click here if you’d like a complimentary copy of Mish’s 2023 Market Outlook E-Book in your inbox.

“I grew my money tree and so can you!” – Mish Schneider

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealth and a special bonus here.

Follow Mish on Twitter @marketminute for stock picks and more. Follow Mish on Instagram (mishschneider) for daily morning videos. To see updated media clips, click here.

Mish in the Media

Mish and Benzinga discuss the current trading ranges and what might break them.

Mish discusses what she’ll be talking about at The Money Show, from April 24-26!

Mish walks you through technical analysis of TSLA and market conditions and presents an action plan on CMC Markets.

Mish presents two stocks to look at in this appearance on Business First AM — one bullish, one bearish.

Mish joins David Keller on the Thursday, May 13 edition of StockCharts TV’s The Final Bar, where she shares her charts of high yield bonds, semiconductors, gold, and regional banks.

Mish joins Wolf Financial for this Twitter Spaces event, where she and others discuss their experiences as former pit traders.

Mish shares her views on natural gas, crude oil and a selection of ETFs in this appearance on CMC Markets.

Mish talks what’s next for the economy on Yahoo! Finance.

Mish joins Bob Lang of Explosive Options for a special webinar on what traders can expect in 2023!

Rosanna Prestia of The RO Show chats with Mish about commodities, macro and markets.

Mish and Charles Payne rip through lots of stock picks in this appearance on Fox Business’ Making Money with Charles Payne.

Coming Up:

April 24-26th: Mish at The Money Show in Las Vegas — two presentations and a book giveaway

April 28th: Live Coaching Complete Trader and TD Ameritrade with Nicole Petallides

May 2nd-5th: StockCharts TV Market Outlook

ETF Summary

S&P 500 (SPY): Tight range to watch this week: 410-415 on a closing basis.Russell 2000 (IWM): 170 support-180 resistance.Dow (DIA): Over the 23-month MA, 336-support to hold.Nasdaq (QQQ): 312 support, over 320 better.Regional Banks (KRE): 44 now pivotal resistance.Semiconductors (SMH): 258 resistance with support at 246.Transportation (IYT): Still under the 23-month MA with 232 resistance, 224 support.Biotechnology (IBB): 130 major pivotal area-135 resistance.Retail (XRT): 58-64 trading range to break one way or another.

Geoff Bysshe

MarketGauge.com

President