You don’t want to miss Mish’s 2023 Market Outlook, E-available now!

As earnings season kicks off, the market is primed to witness some surprising turns in the coming days, weeks, and months ahead. Powell’s speech today kept investors thinking about future interest rate hikes and what that all will mean.

Gold and silver continue to rise as a hedge against inflationary pressures from an increasingly robust labor market, alongside continued consumer spending. Oil is creeping up slowly. Value stocks outperform growth, while the US Dollar is vulnerable. These data points are monitored continuously, to get a clearer idea of where the market will be in a few months.

We also watched similar events unfold, and brought a favorite indicator for times like this! Financial professionals watch these factors across markets closely.

The CAPE Ratio Explained

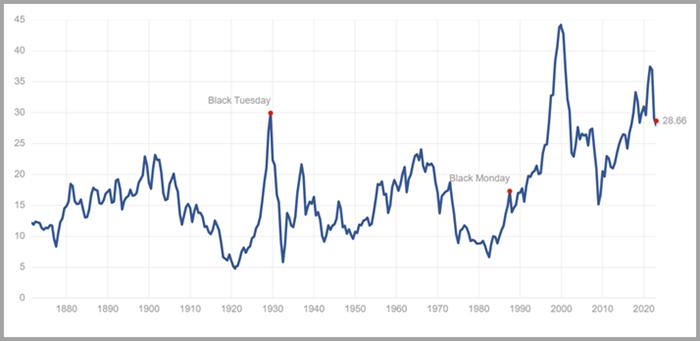

Nobel prize-winning economist Robert Shiller created the cyclically adjusted price-to-earnings (C.A.P.E.) ratio to compile a valuation measure that averages profits over the last ten years, meaning it takes the stock price divided by a 10-year average of earnings. The CAPE Ratio is far from perfect, but it is an interesting measure to judge valuations.

For example, shortly before the dotcom bust in 2000, the Schiller Ratio was at 44. The historical average is 16.7 and, on Tuesday, January 9, 2023, the Shiller Ratio was 28.66 similar in prices to 1929.

The price earnings ratio is based on average inflation-adjusted earnings from the previous 10 years, known as the Cyclically Adjusted PE Ratio or (CAPE Ratio). It’s a simple yet powerful measuring stick that helps identify and analyze trends in the business cycle, equipping those seeking financial gain better insight into potentially inflated market conditions.

Click here if you’d like a complimentary copy of Mish’s 2023 Market Outlook E-Book in your inbox.

For more detailed trading information, contact Rob Quinn, our Chief Strategy Consultant, to learn more about Mish’s Premium trading service.

“I grew my money tree and so can you!” – Mish Schneider

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealth and a special bonus here.

Follow Mish on Twitter @marketminute for stock picks and more. Follow Mish on Instagram (mishschneider) for daily morning videos. To see updated media clips, click here.

Mish in the Media

In this appearance on Business First AM, Mish discusses the worldwide inflation worries.

In this special StockCharts TV presentation, Mish teaches you how to use four simple and reliable key indicators to help you catch big swings in the market.

In this appearance on Business First AM, Mish discusses why she’s picking Nintendo (NTDOY).

Mish sits down with Gav Blaxberg for a W.O.L.F podcast on what she has learned as a trader and teacher.

In this appearance on Business First AM, Mish explains how even the worst trade should not be too bad with proper risk management.

In this appearance on Real Vision, Mish joins Maggie Lake to share her view of the most important macro drivers in the new year, where she’s targeting tradeable opportunities, and why investors will need to keep their heads on a swivel. Recorded on December 7, 2022.

Mish sits down with CNBC Asia to discuss why all Tesla (TSLA), sugar, and gold are all on the radar.

Read Mish’s latest article for CMC Markets, titled “Two Closely-Watched ETFs Could Be Set to Fall Further“.

Mish talks the current confusion in the market in this appearance on Business First AM.

Mish discusses trading the Vaneck Vietnam ETF ($VNM) in this earlier appearance on Business First AM.

ETF Summary

S&P 500 (SPY): 385 support, 395 resistanceRussell 2000 (IWM): 177 pivotal support, 184 resistanceDow (DIA): 333 support, 340 resistanceNasdaq (QQQ): 268 support, 276 resistance.Regional banks (KRE): 56 support, 62 resistance.Semiconductors (SMH): 216 support, 223 resistance.Transportation (IYT): 220 pivotal support, 230 now resistance.Biotechnology (IBB): 127 pivotal support, 168 overhead resistance. Retail (XRT): 60 pivotal support, 66 now resistance.

Mish Schneider

MarketGauge.com

Director of Trading Research and Education

Wade Dawson

MarketGauge.com

Portfolio Manager