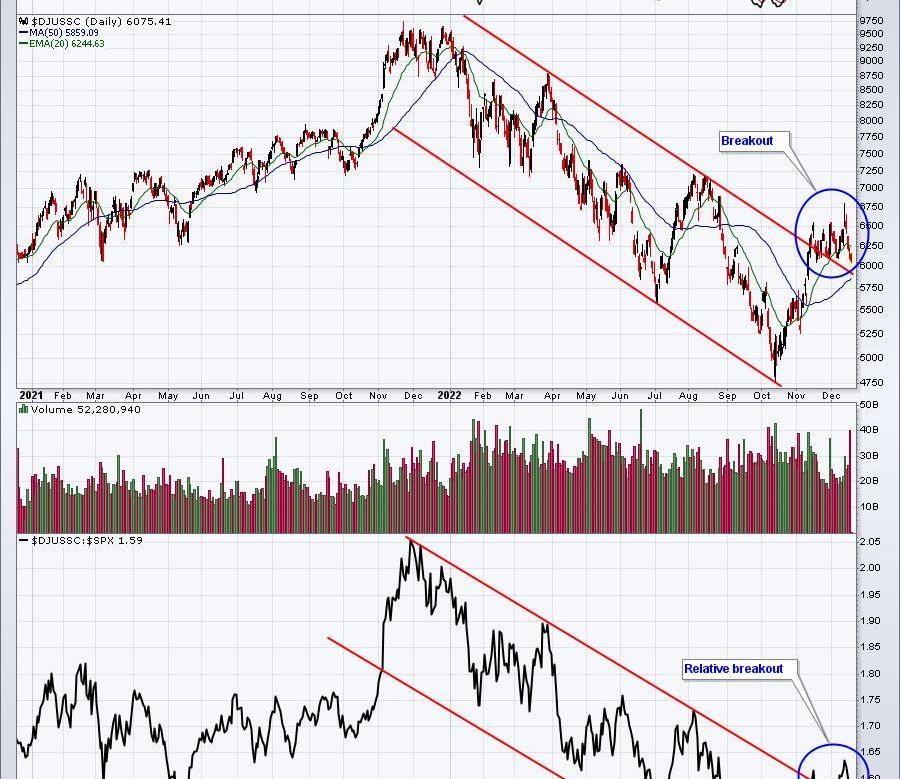

Semiconductors hold the key to a major market advance, in my opinion, as they’re a critical part of the NASDAQ 100 ($NDX). There are 16 semiconductor companies in the NDX, including NVIDIA (NVDA), Advanced Micro Devices (AMD), Texas Instruments (TXN), Applied Materials (AMAT), QUALCOMM, Inc. (QCOM), and Intel (INTC). That’s approximately $1 trillion in market cap between these 6 companies. In addition to representing a significant part of the NASDAQ 100, semiconductors can be a leading indicator of our economy. Therefore, we should pay attention to how they perform. Check out this relative 2-year daily chart:

The good news is that it appears the lengthy absolute and relative downtrends have been broken. But are they false breakouts? We don’t know that right now, but what we do know is that semiconductors are testing a very critical short-term price support level. Failure here and the overall market, particularly the NASDAQ 100, could be poised for yet another drop. Check out the DJUSSC’s hourly chart:

Price support has clearly been established at 6100. How the DJUSSC closes today could influence the NASDAQ 100 today, but more importantly, over the next few weeks. I do like that as absolute price support sees test after test, the DJUSSC is showing improving relative strength. Is this a sign that we’re about to see a significant rally? Or will the DJUSSC tumble again once this support is lost? Either way, I’d say this level will be one to watch today and throughout this week.

Semiconductors will likely be discussed significantly at our MarketVision 2023 event. This is our 4th annual MarketVision event and it will be held on Saturday, January 7th. It’s a FREE virtual event that requires no credit card. You can CLICK HERE for more information and to register for the event. We are expecting to reach capacity, so please register NOW! I hope to see you there!

Happy trading!

Tom