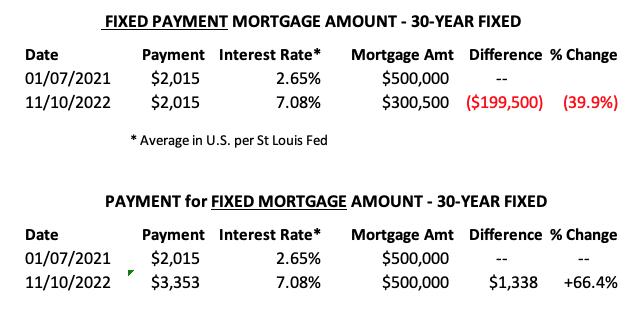

We watch the 30-Year Fixed Mortgage Interest Rate, because, for the most part, people buy homes based upon the maximum monthly payment they can afford. As rates rise, a fixed monthly payment will carry a smaller mortgage amount. As buying power has been shrinking, home prices have come under pressure.

This week the 30-Year Fixed Rate fell from 7.08 to 6.61. What strikes us about this is that it appears that mortgage rates are lagging behind Treasury yields by about a month. Since Treasury yields are currently rising again, this week’s dip in mortgage rates is not likely to persist, but homebuyers can hope.

Is the Real Estate sector now poised to do well? It actually looks pretty good right now. After price fell and tested the 20/50-day EMAs, it managed to close above the 50-day EMA today and above the June low. The RSI is positive and the PMO is now rising above the zero line. Best of all the Silver Cross Index (SCI) and Golden Cross Index (GCI) are both rising. Participation is robust enough to look for a rally continuation. Stochastics and relative strength are both turning back up.

Conclusion: Mortgage rates moved much lower this week. It is likely to provide some relief for home buyers and by the looks of the XLRE chart, it could push price higher moving into next week.

Good Luck & Good Trading!

Carl Swenlin and Erin Swenlin

Watch the latest episode of DecisionPoint on StockCharts TV’s YouTube channel here!

Technical Analysis is a windsock, not a crystal ball. –Carl Swenlin

(c) Copyright 2022 DecisionPoint.com

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.