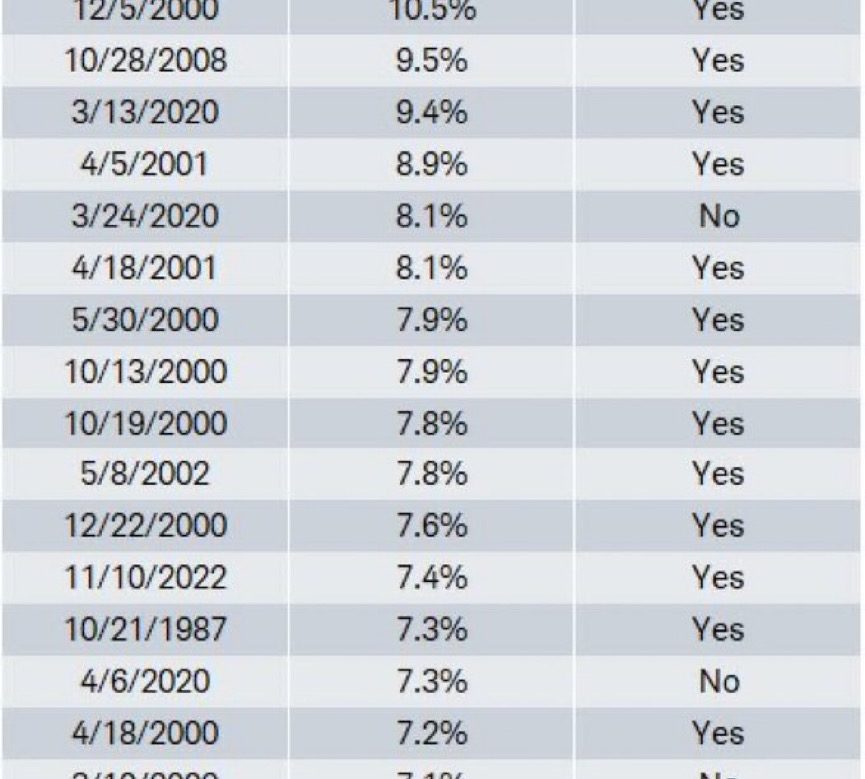

With Thursday’s breakout, many charts around the world broke out. If it is a bear market rally, it’s a very convincing one. I saw a nice list from Charles Schwab that shows how many of these super surge days there have been and if they were in a bull or bear market.

From Charles Schwab:

I went back to look at the chart for the ones that occurred in 2008 and 2009. Interestingly, there were some rallies that looked way bigger than March 9 or March 23, like the November low. I find it interesting that the March 2009 rallies were not in a bear market? Maybe with hindsight, you can say that was the start of the bull market? Some questions to the data, but they do give us some dates for comparison.

The move this week was dramatic, squeezing short sellers in a big way which is also why the thrust up was extraordinary. For me, it was a great rally as we change from bear to bull. The Dow was already above the 200 DMA, but the Nasdaq was not. My bias for now is bullish.

I got whipsawed as I started to see gains evaporating into Wednesday and sold my portfolio as the market struggled. Missed a nice upside day, but there is always another train at the station. I guess that is the price of playing defence in a bear market.

I like the price action I’m seeing here and I’ll have a complete review for members on the weekend. If you are interested in why this week marked a major change for me in the markets, you can try a $7 subscription for a month and see if the PLUMB system works for you. Choose the $7 option on this page for more information. There is also a nice video about how we approach the market on this page. Osprey Strategic Approach.