Chartists considering a trend-following strategy can use the Trend Composite to identify trend signals and then turn to the ATR Trailing Stop for an exit strategy. A bearish Trend Composite signal could also be used as an exit strategy, but these signals usually trigger later than the ATR Trailing Stop and result in larger losses. Today’s commentary will show examples with the Finance SPDR (XLF) and the Semiconductor ETF (SOXX).

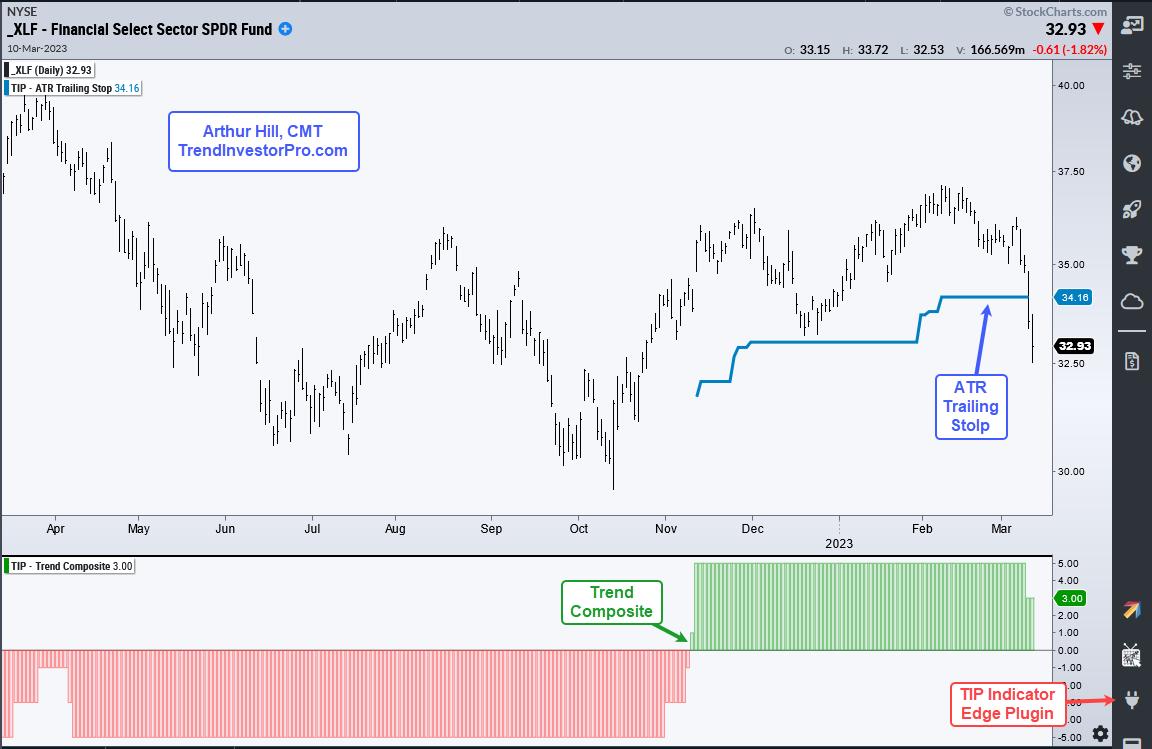

The first chart shows the Finance SPDR (XLF) with the Trend Composite turning positive (green) on November 9th and the ATR Trailing Stop starting the next day, which is when an entry order could be placed. The Trend Composite aggregates trend signals in five trend-following indicators. The ATR Trailing Stop (blue line) is 5 ATR values below the highest close since the trend signals. Note that these two indicators are part of the TIP Indicator Edge Plugin for StockCharts ACP.

XLF triggered this trailing stop with a sharp decline on Thursday. This trade resulted in a loss of around 6%. Note that the Trend Composite is still positive. The next chart shows the Semiconductor ETF (SOXX) with the Trend Composite turning positive on January 23rd and the ATR Trailing Stop starting the next day. SOXX is down a fraction since January 24th, but remains above the ATR Trailing Stop. SOXX is still in plan and holding up better than XLF right now.

TrendInvestorPro is currently working with three quantified strategies for trading ETFs. The All Weather Strategy uses the Trend Composite and StochClose rank for signals. We have a Trend-Momentum Strategy for 74 stock-based ETFs and a Mean-Reversion Strategy for a broad list of 275 ETFs. Each strategy comes with a detailed article, quantified results and signal tables. Click here to learn more.

The Trend Composite, ATR Trailing Stop and nine other indicators are part of the TrendInvestorPro Indicator Edge Plugin for StockCharts ACP. Click here to learn more and take your analysis process to the next level.

—————————————